Affordable SR22 Insurance in Dallas with Texas Best Policy Store

In the bustling city of Dallas, where highways and streets connect every corner, motor vehicles are indispensable. Accidents and traffic violations have risen along with population growth, highlighting the importance of SR22 insurance. Know more about what is sr22 insurance

SR-22 Dallas TX, also known as a Certificate of Financial Responsibility (CFR), is a special form of auto insurance. Texas authorities require SR22 for drivers considered high-risk. While it’s not an insurance policy, SR22 guarantees coverage compliance.

Dallas has seen a rise in SR-22 insurance needs as accidents and citations climb. According to the Texas Department of Transportation, at-fault accidents rose by 67% in Dallas County over two years.

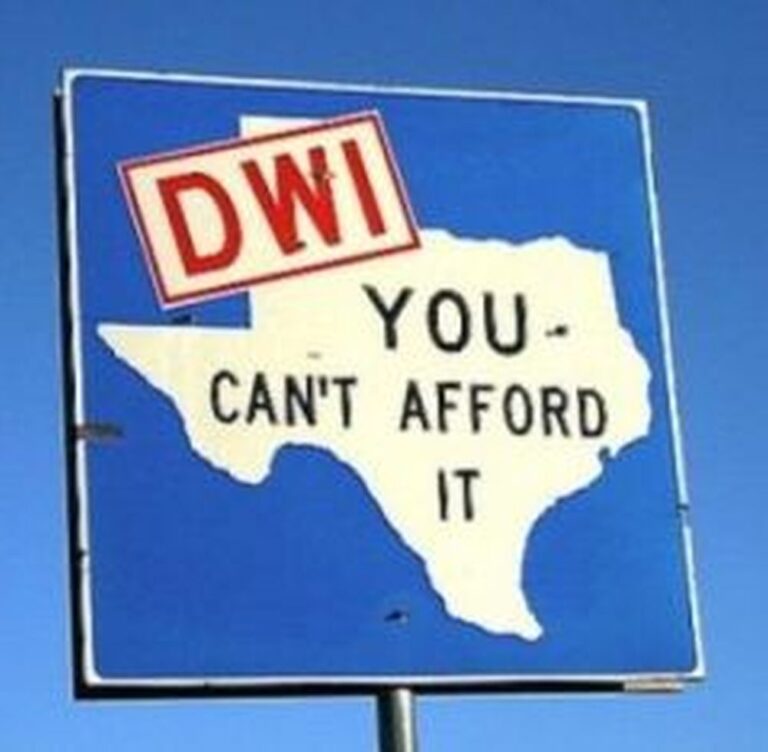

Why SR22 insurance matters for high-risk drivers in Dallas. The SR-22 filing is proof of auto insurance for high-risk drivers. It is required after serious violations like DUI/DWI, reckless driving, or driving without insurance. Learn more at https://www.policy-store.com/.

Who must carry SR22 in Dallas, TX. Drivers with serious traffic incidents, license suspensions, or excessive points may need it.

Duration of SR22 insurance in Texas. Filing generally lasts 1-3 years as mandated by TxDOT.

Finding the right insurance company for SR22 in Texas. It’s important to choose a provider familiar with SR22 requirements. You can look here for quotes: www.policy-store.com.

Even without owning a car, you can maintain SR22 coverage.

Letting SR22 insurance lapse may result in license suspension.

Getting an SR22 filing in Dallas is usually quick.

SR22 insurance transfers when relocating to Texas.

Compare SR22 insurance quotes to find affordable rates. You can look here: www.policy-store.com.

Remember, SR22 insurance ensures compliance and financial responsibility.